+32.2.741.24.46

office@eusanctions.com

ABOUT US

EU SANCTIONS is an independent consultancy focusing on EU export control and sanctions laws, including EU dual-use regime, EU sanctions and restrictive measures, and EU defence export controls, both at the EU level and the national level. We are strategically located in Brussels, the seat of EU institutions active in trade controls: the European Commission (dual-use), the EU External Action Service (sanctions/restrictive measures), the Council of Ministers and the European Parliament. With close proximity to main decision-makers in trade controls, we are able to act effectively in a cost-efficient manner.

We employ EU trade lawyers experienced in trade controls in the European Union and other jurisdictions. Our aim is to provide expert, cutting-edge, and cost-efficient advise to EU, foreign and international companies whose interests are or may be affected by EU trade controls: EU companies exporting dual-use or defence goods or operating in countries subject to EU sanctions/restrictive measures, foreign companies exporting into the EU, concerned with their ability to reexport dual-use or defence items out of the EU, or to countries subject to EU sanctions/restrictive measures.

Team Leadership

Tomasz Włostowski

Managing Partner

+32.470.542.844

tomasz.wlostowski@eusanctions.com

Tomasz Włostowski has over 12 years of experience practicing international trade including sanctions/restrictive measures and export controls in the EU and the US, as well as at the UN level.

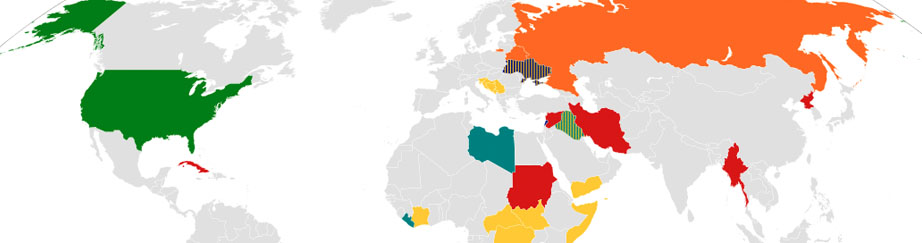

In the EU, Tomasz has advised domestic and foreign entities on all types of EU trade controls both at the EU and Member State level, including various types of sanctions/restrictive measures (including on Belarus, Iran, Iraq, Libya, Myanmar, North Korea, the Russian Federation, Sudan, Syria, Ukraine and Zimbabwe), as well as controls on dual-use and defence exports. The focus of his work has been both on compliance with existing sanctions and on preparation and use of new sanctions by EU entities to gain competitive advantage. Tomasz has been published and quoted in numerous publications and newspapers on these topics.

Before founding EU SANCTIONS, Tomasz worked for 4 years in Hogan Lovells in Brussels dealing with, among others, EU sanctions and export controls. Prior to that, he worked for 5 years in Washington, D.C. for White & Case LLP working on international trade, including sanctions (OFAC), export controls (EAR) and defence controls (ITAR). Tomasz completed his studies in the United States (LL.M.and J.D., cum laude, University of Florida) and Poland (mgr praw, Warsaw University).

OUR EXPERIENCE

Our lawyers have advised clients on many aspects of EU trade controls, including dual-use, sanctions/restrictive measures and defence controls, both at the EU as national level. For example, our lawyers have represented parties in, advised clients in relation to, or been involved in, the following engagements:

Our lawyers have advised clients on many aspects of EU trade controls, including dual-use, sanctions/restrictive measures and defence controls, both at the EU as national level. For example, our lawyers have represented parties in, advised clients in relation to, or been involved in, the following engagements:

SANCTIONS/RESTRICTIVE MEASURES

- advising an EU sanctions compliance program for an EU professional services provider;

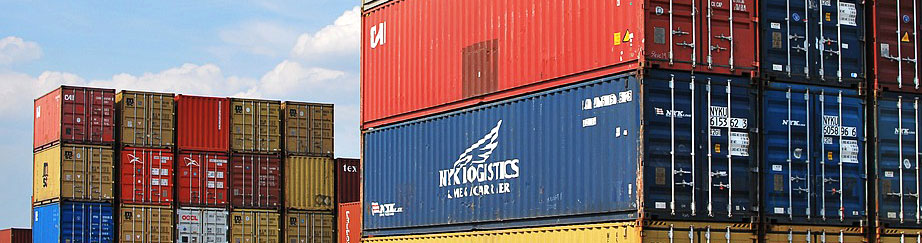

- advising an non-EU shipping company on the status of its containers, destined for an EU-sanction country, wrongly detained in an EU port;

- advising a non-EU certification company on its obligations to comply with EU sanctions/restrictive measures;

- advising a non-EU service provider on its ability to continue certain interactions with a sanctioned entity;

- investigating and preparing and filing a voluntary disclosure to an EU national enforcement authority for violation of Libyan sanctions by Libyan operations of an EU subsidiary of an Asian services provider;

- advising an EU entity on whether provision of back-office services to a joint venture involving listed sanctioned entities would be allowed;

- advising EU and non-EU entities on their ability to accept payments from entities located in various countries subject to EU sanctions/restrictive measures;

- advising an EU entity on whether its overseas employees are subject to EU sanctions/restrictive measures;

- advising an EU entity on how passive investment by listed sanctioned entities into a joint venture with an EU entity should be treated under EU sanctions/restrictive measures.

DUAL-USE

- advising a non-EU software developer on establishing its EU operations, including performing a complete audit of its activities, registration with a national licensing authority, advise and representation during an audit by the national licensing authority, as well as following up an any post-audit activities;

- advising an EU software developer on EU encryption controls in software installed onto a hardware to be marketed across the EU as well as exported;

- advising a UK exporter on its ability to use UK’s OGEL for cryptographic development;

- performing an audit of EU operations of a non-EU corporation, filing a voluntary disclosure of past violations with two EU national licensing authorities and helping the entity to register and comply with EU and national trade controls.

- advising a US corporation on EU brokering dual-use controls.

DEFENSE

- advising an EU IT company on whether the Intra-EU Defense Transfers Directive’s concept of “certified undertaking” will cover software providers;

- advising a non-EU company on whether certain materials and substances are covered by the common EU military list;

- advising a non-EU company on defense brokering regulations in the EU, as well in a number of EU member states;

- counseling EU defense conglomerate on EU developments in defense export controls;

- helping a non-EU company register its subsidiary with national defense licensing authority; and

- advising a non-EU entity on the binding nature of EU’s Common Position on Arms Exports.

OUR SERVICES

Most EU companies that carry on export activities out of the EU are affected by EU trade controls. This is particularly the case for companies involved in trading in dual-use or defense items. But even companies involved in trade in non-sensitive items may be affected by EU trade controls. This is because EU sanctions/restrictive measures prevent EU companies (or, in some cases, even foreign entities) from doing business, or engaging in certain transactions or activities, either with certain natural persons or entities subject to EU restrictive measures/sanctions, or with certain countries. Even when trading with a non-EU sanctioned country, companies have to exercise due diligence to ensure that the item they are exporting will not be diverted to a sanctioned entity or country, in violation of EU sanctions or restrictive measures.

Given the complexity of EU trade controls, and the various ways they can come up in the course of companies’ business activities, the services clearly depend on the type of business affected by EU trade controls and the specific controls at issue. Below is the list of the services that we are most frequently asked to provide.

- Impact of sanctions/restrictive measures on ongoing transactions. EU sanctions/restrictive measures change frequently. For companies operating in volatile regions, this means constant change to regulatory environment applicable to their transactions. List of banned entities, shipments, or destinations, as well as other requirements (licenses, notifications, or recordkeeping) keeps changing. So do lists of prohibited involvement in countries and regions. Different drafting of similar provisions in different sanctions/restrictive measures regimes complicates keeping track of the developments. Obtaining payment for past or ongoing transactions becomes more difficult. Managing joint-ventures with sanctioned entities – in the EU or even abroad – becomes an increasing nuisance. We help companies properly identify how changing regulations affect their business and ongoing transactions and suggest the best course to take.

- Classification. Proper classification of dual-use and defense items is crucial to export control compliance. It affects license applications, the ability to use EU or national general and individual export licenses or exemptions as well as proper recordkeeping. With increasing commercialization of defence technologies, the separation between defence and dual-use items becomes increasingly difficult as well. We help clients maneuver this complex area.

- Regular Updates. As EU sanctions/restrictive measures legislation is amended very often, it is of crucial importance for clients to keep up to date with most recent amendments. We provide custom-tailored updates to each of our clients, providing the type of information most relevant to them, either because of their industry focus, or countries concerned, or type of restrictions.

- Export Compliance Programs. Each company involved in exports should have an Export Compliance Program, which sets out the procedures that – when followed – ensure compliance with EU export controls and sanctions/restrictive measures. Export compliance programs must be very detailed and continuously updated as EU export control and sanctions/restrictive measures legislation is amended, to ensure prompt compliance and accuracy.

- Audits. It is important for companies involved in export activities to double-check their compliance with export control and sanctions/restrictive measures legislation. We help companies analyze their past export control performance, i.e., reviewing their exports, shipments and payments and confirming that all EU trade controls (including licensing, notification, recordkeeping, and other requirements) have been complied with.

- Voluntary Disclosures. In case the company identifies any shortcomings or violations in its export control performance, we help companies interact with enforcement agencies to prepare voluntary disclosures and ensure favorable treatment by authorities.

Before we provide services, we discuss with the clients their goals, as well as their financial constraints. We realize that money spent on trade compliance – while necessary and mandatory – is also an expense that must be warranted from the business perspective. After identifying the key risk and opportunities, we explain to the clients the magnitude of work and research to be done, which influences the costs, so the clients are in a position to decide whether the cost of legal advice can be supported by underlying transaction, or whether to withdraw from transactions or business plans considered immediately. Our main directive is to provide accurate advice and excellent service, while not wasting our client’s money.

ABOUT TRADE CONTROLS

GENERAL

EU trade controls include a number of different sets of rules, regulated by different types of legal acts, which have – in general – two things in common. First, they all regulate export activities of EU nationals and businesses, and, in some cases, export activities of foreign nationals and businesses that have sufficient links to the EU. Due to that link to exports, trade controls are more commonly referred to as “export controls”. Second, they are all justified and triggered by security-type concerns against foreign countries, including non-proliferation, peace and security, as well as maintaining technological and defense superiority over certain countries. In general, we can distinguish three types of EU trade control rules: EU export controls on dual-use items, EU export controls on defense items, and EU sanctions/restrictive measures.

EU SANCTIONS/RESTRICTIVE MEASURES

EU sanctions/restrictive measures are the most complex of EU trade controls. First, they target EU many different countries (e.g., Iran, North Korea, Syria, Zimbabwe and many others). Second, the list of acts/transactions prohibited by sanctions is different for each targeted country (thus, the prohibitions applicable to Iran are different than, for example, North Korea). Third, they are implemented through many different EU legal instruments (Council Decisions, Council Implementing Decisions, Council Regulations, Council Implementing Regulations, Commission Implementing Regulations, and Notices) each of which plays a different role and has a different impact. Fourth, implementation of sanctions involves application of EU Member State law, as the enforcement is at the local level, thus – in light of many ambiguities in EU sanctions legislation – implementation at the Member State level may be different in different EU countries. Fifth, implementation and enforcement at the local level is done by many different Member State authorities, including ministries responsible for trade/economy, ministries for foreign affairs, ministries for defence, ministries for finance, central banks, immigration officers, customs services, courts/registries responsible for registration of legal entities and others. Six, as EU sanctions are adopted in response to international and/or internal developments requiring quick action, they often change and – in many cases, in particular in regards to asset freeze – do not provide for a vacatio legis period, but instead are immediately applicable on the date of their publication. All this contributes to the complexity of this area of law.

The most typical types of sanctions include:

- Arms Embargo. An arms embargo prohibits the exportation of defence items to the targeted countries, as well as – usually – provision of related financial, technical and brokering services. Some of the countries targeted by an arms embargo include Afghanistan, Eritrea, Republic of Guinea, Iran or Syria).

- Asset freeze. Asset freeze provisions require EU persons to freeze the assets of specific natural and legal persons listed in the regulations, as well as prohibit the provision of assets to such persons. Most of EU sanctions programs have asset freeze provisions.

- Entry/visa ban. This ban prevents certain foreign individuals from entering, or transiting through, the territory of the EU. This ban usually covers officials of the targeted government, officials of its judicial or law enforcement apparatus, or businessmen supporting the targeted regime, or reaping rewards therefrom.

- Export ban. Export bans prohibit the exportation of certain items to the targeted countries. In most cases, their purpose is to deprive the country from dangerous items or items that are important to the condemned regime. The lists of prohibited items differ depending on the targeted country and include WMD-related items (e.g., Iran, Syria, or North Korea), equipment for internal repression (e.g., Iran, Syria, or – now repealed – Uzbekistan), information technology and communication items (e.g. Syria, Iran), dual-use items (e.g., Iran), coins and banknotes (e.g., Iran and Syria), luxury items (e.g., North Korea or Syria) and others.

- Import ban. Import bans prohibit the importation of certain items from the targeted countries. In most cases, the purpose of an import ban is to deprive the condemned regime from sources or revenue. Lists of prohibited items differ depending on the targeted country, but can include products of extractive industries (e.g., now suspended Burma/Myanmar) or oil (e.g., Iran and Syria).

- Investment ban. Investment bans prevent persons subject to EU sanctions (mainly, EU nationals and entities) from investing in certain sectors of the targeted country’s economy. In most cases, such sectors are either the reason for the sanctions (e.g., Iran’s nuclear industry), are sources of revenue for the targeted regime (e.g., Syria’s and Iran’s oil industry), or underinvestment would add a pressure on the regime (e.g., Syria’s electricity generation), or would deprive the regime of ‘dangerous’ items (e.g., Iran’s manufacturers of dual-use items or internal repression items).

- Bank transfer restrictions. Bank transfers restrictions subject to licensing or to notification transfers of funds to recipients in the targeted country. So far, Iran is the only country subject to such measures.

- Prohibition of certain financial services. Prohibition of financial services seeks to deprive the targeted country from EU funding. It often comes in the form of a ban on purchase of public or public-guaranteed bonds (Syria), opening of bank accounts or entering into cooperation with financial institutions in, or opening of offices in, the targeted country (e.g., Iran or Syria), ban on opening of offices in the EU by the targeted country’s financial institutions (e.g., Iran or Syria), ban on provision of insurance or reinsurance to the targeted country, its government, or its public bodies (e.g., Iran or Syria).

There are many other types of EU sanctions/restrictive measures as well.

EU DUAL-USE EXPORT CONTROLS

EU dual-use export controls regulate the conditions under which dual-use items, i.e., those items that have both military, as well as commercial use. They are regulated both at EU, as well as national level. EU laws sets the parameters and general requirements. National law of the exporter specifies the detailed licensing procedures, as well as enforcement rules.

- Dual use items. At the EU level, EU export controls apply to items listed in Annex I to the EU dual-use regulation. Pursuant to the Wassenaar Arrangement, those items, are grouped into 9 categories: nuclear materials, facilities and equipment (Category 0), special materials and related equipment (Category 1), materials processing (Category 2), electronics (Category 3), computers (Category 4), telecommunications and “information security” (Category 5), sensors and lasers (Category 6), navigation and avionics (Category 7), marine (Category 8 ) and aerospace and propulsion (Category 9). Within each category, items are divided according to their role within each category, and so they include systems, equipment and components within that category (A), equipment used to test, inspect and produce items within that category (B), materials used within that category (C), software used within that category (D) and technology related to this category (E). EU member states may apply export dual-use controls to other dual-use items, not listed in Annex I, although few of them do.

- Catch-all controls. In addition, EU export controls may apply to dual-use items not listed in Annex I, if the exporter has been informed by authorities that the dual-use goods may be diverted for certain WMD proliferation activities, or violation of an arms embargo, or in certain other circumstances.

- Licensing. EU exports controls boiled down to the concept that dual-use items exported out of the EU must be licensed. Licenses can be either general or individual nature. General licenses are published in law (either EU or national) and entitle all exporters that meet the criteria to use them. Each general license (EU or national) specifies the goods and countries that it covers, as well as any conditions for its use (for example, recordkeeping requirements or duty to use specific language in export declarations). Usually, only registration with national authorities and notification is required. Individual licenses are issued by authorities of EU member state where the exporter is located. They must be applied for and once issued they can be used only by the exporter to whom they were issued. They specify the goods and countries that they cover, as well as any conditions (for example recordkeeping) for their use.

- Enforcement. Enforcement of EU and national dual-use export controls is handled exclusively at the national level, but relevant authorities in each member state.

EU DEFENSE EXPORT CONTROLS

EU defense export controls are predominantly the realm of national law. At the EU level, only four types of regulations on EU arms exports exist: (1) harmonization of a list of defense items (EU Common Military List), (2) harmonization of criteria for licensing of arms exports (EU “Code of Conduct” on Arms Exports), (3) harmonization of rules on brokering in military equipment, and (4) facilitation of intra-EU defense transfers (Intra-EU Defence Transfer Directive).

- EU Common Military List. At the EU level, the EU harmonized the list of defence items subject to export controls referred to as „the EU Common Military List”. This list is updated annually by the EU.

- EU Code of Conduct on Arms Exports. Since 1998, EU Member States have harmonized the criteria for licensing defense items through the so-called “Code of Conduct on Arms Exports”. In 2008, the informal Code of Conduct was formalized through an official Council Common Position. In essence, under the Common Position, all EU Member States are bound to require a license for exports of items listed on the EU Common Military List. They also undertake to use the identical 8 criteria for considering defense export applications, which include respect for the international obligations and commitments of the EU nations (including UN or EU sanctions, non-proliferation agreements and other international obligations), respect for human rights, internal situation of the receiving country, preservation of regional peace, national security of the EU Member States, and friendly and allied countries, behaviour of the buyer country, risk of divertion, and others.

- EU Common Position on Arms Brokering. Since 2003, the EU Member States have harmonized their rules on arms brokering. Specifically, they have undertaken to control brokering in arms transactions within their territory, and “are encouraged” to control brokering outside of their territory by their nationals and entities established within their borders. EU Members states should maintain record for at least 10 years of any brokering licenses and may subject brokering to a licensing requirement. EU Member States differ in how they implement the Common Position.

- Intra-EU Defense Transfers Directive. In contrast to dual-use items, defense items are not subject to the free movement of goods in the EU. This means that for sale of defense items listed on the EU Common Military List from one EU country to another EU country, an export license would need to be obtained. The 2009 EU Directive on intra-EU transfers of defense items is aimed at addressing this issue. Among other provisions, it calls for EU member states to (i) exempt from the licensing requirement certain transfers (mainly, to armed forces of other EU Member States); (ii) create certain general licenses (i.e., those that do not need to be applied for, but instead can be used by anyone meeting the criteria), including for other EU member states, for fairs, and for “certified undertakings”, (iii) create global licenses (i.e., those licensing multiple exports to multiple countries), and (iv) limit the need for individual export licenses for intra-EU transfers only to limited circumstances. One of the most important concepts of the Directive is the concept of a “certified undertaking”, which allows certain EU companies to get certified, in order to have facilitated receipt of controlled defense item (i.e., transfers to “certified undertakings” would not require an individual license, but can be done under a general license mandated by the Directive). To be certified, the recipient must fulfill certain criteria, including have a proven experience in defence activities, good track record of export control compliance, proven employment of experienced management staff, relevant industrial activity in defence-related products within the Community, in particular capacity for system/sub-system integration, and having a dedicated export control officer and others.

CONTACT US

Street address:

Rue Abbé Cuypers 3

1040 Brussels BE

Phone: +32.2.741.24.4

Fax: +32.2.741.24.12

Email: office@eusanctions.com